Blog

"I Want Custody" - How to File in Virginia

“I want to file for custody of my child. How do I do that?" As you can imagine, this is one of the most common questions posed to a Family Law Attorney. Because filing for child custody or visitation is a stressful and confusing endeavor, we wanted to take a few minutes to share some information. However, we cannot offer specific legal advise in this post because every case is unique. That being said, we strongly encourage you to speak with an experienced Virginia Family Law Attorney about your circumstances.

Issue 1: What do I file in Virginia?

In Virginia, custody and visitation cases are normally initiated when a parent or other interested party files a "Petition". This assumes that there has never been any other court cases involving your child (if so, you would likely need to file a different pleading known as a "Motion to Amend") and that Virginia has jurisdiction (see below). Depending on the locality where your Petition is filed, you may have to make an appointment. You will also typically be required to pay a filing fee, and to fill out a Uniform Child Custody Jurisdiction and Enforcement Act Affidavit. Because of the varying policies of the different localities, it is advisable that you contact the locality where you plan to file in advance, or do some online research--Henrico County, for example, posts information about filing petitions on their website.

Read moreDifficulties in Divorce: Settling Before Court

In Virginia Divorce cases, we work hard with our clients to attempt to resolve each case by settling out of court. Believe it or not, in our experience, most cases are resolved before Court. Why is that?

- Because it is almost always in everyone’s best interest to finalize a case as quickly as possible.

- The parties save money and time, and shield themselves from unnecessary emotional turmoil that naturally comes from battling things out in a courtroom.

- If you have children, it is even more important to reach a resolution; the longer litigation lingers, the more your children will get dragged into the middle.

Suffice it to say, you should strongly consider an out of court settlement, provided the terms are reasonable and equitable. How do you decide when a settlement offer is reasonable and fair? Great question. The answer depends on the facts of your case. This is one area where your attorney’s experience will play a significant role.

Read moreDifficulties in Divorce: Dealing with Retirement Accounts

Any Virginia Divorce Lawyer will tell you that the first consultation with a potential client is a difficult task. Going through a divorce is a painstaking process, especially when the parties have significant marital assets and/or debts to distribute. One of the most common headaches is figuring out how to divide retirement accounts. Most people are exceedingly frustrated to learn that they might have to fork over a portion of their retirement to their ex-spouse (the frustration boils if their spouse is the one seeking a divorce). We thought it would be appropriate to answer a few FAQs.

What portion of your retirement account does your spouse get under Virginia law?

As with most things, it depends. Only the "marital" portion of a retirement account is subject to division and distribution by a Judge. Generally speaking, the marital portion of your retirement account is the amount of your contributions from the date of your marriage to the date of your separation (appreciation/depreciation of that amount is typically considered as well). However, what your spouse actually gets really depends on the other circumstances of your case.

Read moreChild Support in Virginia: What You Should Know About Upcoming Changes in the Law!

Our legislature has stepped up to the plate and enacted new child support laws and guidelines. The new guidelines will mark the first amendment in over 25 years. Highlighted below are two significant changes to the Virginia Child Support laws:

Child Support Guidelines

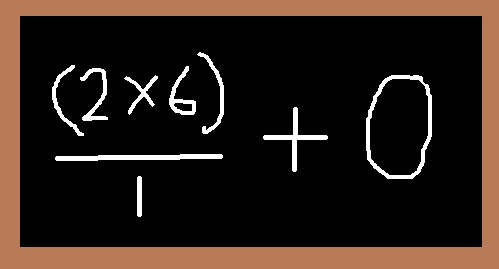

If you look at the current Virginia Child Support Guidelines statute (Va. Code 20-108.2), you will see a long table with presumptive monthly child support obligations, based on the combined monthly gross incomes of the parents--aptly titled "Schedule of Monthly Basic Child Support Obligations". This table will be different in July 2014 when the amended statute takes effect. If you look at the revisions (here: HB 933), you will immediately notice the differences. The most notable:

Read moreDifficulties in Divorce: Filing Your Tax Returns

It’s that time of year: Tax Time!

Each year, as the dreadful deadline of April 15 approaches, we are confronted with questions from clients about how they should deal with filing taxes. These inquiries are so common we thought it might be beneficial to post a few bits of information in order to highlight some issues that frequently arise. Please note: you should be sure to speak directly with your tax-advisor or attorney for specific advice regarding your tax filings.

Situation A: Separated, but not yet Divorced.

- Do I file jointly or separately?

- Who claims mortgage interest deductions?

- Who claims the children?

These are very good questions. If you have a current custody and/or support order, or a property settlement agreement, be sure to check whether these issues are addressed. It is common for court orders and agreements to address all of these issues, as it makes the process of filing taxes easier on both spouses. It would also be wise to consult the Internal Revenue Service’s website, as it answers a lot of common questions. It is important to speak with your tax-advisor or attorney before deciding whether to file jointly or separately. Often times, it will make more financial sense to file jointly because of the tax benefits—however, a joint filing can create arguments over how to divide the tax return. It is common for the tax refund to be held in escrow by your attorney until you and your spouse can agree on the division of the refund. If your spouse claims a deduction (i.e. mortgage interest, children) that you believe you might be entitled to, it would be wise to immediately consult an attorney or tax-advisor.

Read more

The Facebook Frenzy in Virginia Family Law Cases

Take a look around our social media-driven world and you will struggle to find someone who is not active on Facebook, Twitter, or Instagram. Our newfound desire to publish snippets of our personal lives to a massive audience is astounding. And while it is nice to be able to keep in touch with friends and family, these outlets can be dangerous as they tend to create powerful evidence in Virginia family law and divorce cases. In around fifty percent of our contested divorce and child custody cases over the past few years, there is at least one piece of evidence that comes from a social media account—Facebook, primarily. The most common are photographs of a parent consuming alcohol, or comments that admit important facts or display cruel and abusive behavior. While we strongly encourage you to close any social media profiles, most disobey that advice.

Lesson 1: Watch What You Post

If you insist on being an active member of the social media world, despite being in the middle of a contested divorce or child custody dispute, think twice before you post something on the internet. For example, if you are separated from your spouse but are still married, think twice before posting pictures of you and your new boyfriend/girlfriend. If you are in the middle of a custody dispute, think twice before bad-mouthing the other parent. While you may not expect the other person to notice, in our experience they usually will. And then they will share the information with their attorney who will aim to use it against you in Court.

Read moreThe Role of a Guardian Ad Litem in Virginia Child Custody and Visitation Cases

If you are involved in contested child custody or visitation case in Virginia, chances are there will be a guardian ad litem appointed to represent your child. Therefore, it is important that you familiarize yourself with the role of the guardian.

What is a Guardian Ad Litem?

Guardians are Virginia attorneys who are appointed by the Court in certain cases to represent minors or other incapacitated individuals. In Virginia, guardians are frequently appointed to represent children who are the subject of a custody or visitation dispute. When appointed, a guardian’s job is to represent their client—the child—and to advocate for their client’s best interests. Thorough guardians conduct a time-consuming investigation prior to trial, which would normally include interviewing the parents, extended family members, relevant third parties (i.e. counselors, psychologists, daycare providers, teachers), and other witnesses. It should also include “home visits” (observations of the homes of the parents or third parties who are competing for custody/visitation) and reviewing important records (medical records, report cards, disciplinary records, etc.). A guardian ad litem will also participate in the trial. They may introduce evidence, question witnesses, and make a recommendation to the Judge as to what custody and visitation arrangement they believe is in the child’s best interest.

Read moreGrandparent's Rights in Virginia Child Custody and Visitation Cases

It is a well-known fact that grandparents are often actively and intimately involved in the lives of their grandchildren. Their roles often increase when the parents of their grandchildren are separated. Grandparents may transform into daycare providers, character witnesses, visitation supervisors, and the list goes on. In light of their involvement, grandparents are often concerned about the welfare of their grandchildren and ask us about their legal rights pertaining to custody and visitation. Because of the interest surrounding this topic, we felt it would be appropriate to post some general information. This post is not intended to offer legal advice. Every circumstance is unique and you should speak with an experienced family law attorney for specific advice.

Read moreDifficulties in Divorce: Spousal Support Litigation in Virginia

It should come as no surprise that spousal support (Alimony) is often a hotly contested issue between a husband and wife during the divorce process. The primary wage earner in the family (a.k.a. the breadwinner) almost never wants to pay support, while the lower wage earner (often the homemaker) usually asks for financial assistance. This disconnect often leads to litigation. In Virginia Circuit Courts, Judges have the express authority to award alimony to a spouse upon their request, which usually occurs incident to a divorce proceeding. Assuming that the parties are unable to reach an agreement on support, Judges will typically conduct a hearing, listen to the evidence, and then look primarily to Virginia Code Sections 20-107.1 and 20-109 to analyze the issue before reaching a decision. If you are in the midst of a divorce that involves the issue of spousal support, it is important that you review these statutes very carefully.

Read moreAnnulment vs. Divorce

Because we get asked this question often, we thought it would be prudent to clear up some common misconceptions about the grounds for Annulment. Let’s start with the basic definitions: An Annulment is a legal declaration that a marriage was invalid (a.k.a. null and void). A Divorce, on the other hand, terminates a marriage between two parties. A divorce does not negate the legality of a marriage, it simply dissolves the marriage.

Grounds for an Annulment

It is surprising to most that the grounds for annulment are very limited and are broken down into two categories: void and voidable marriages.

Read moreChild Custody and Visitation - Best Interest Factors

If you are a parent who is going through a child custody and/or visitation dispute in Virginia, it would be wise to review the statutory factors that the Judge must consider in making his or her decision. Commonly referred to as the “Best Interest Factors”, Virginia Code Section 20-124.3 is designed to help Judges make a decision that is in the best interest of the minor child who is the subject of the litigation. The Best Interest Factors are fairly self-explanatory and most come as no surprise—relationship between parent and child, physical and mental condition of the parties, history of family abuse, etc. However, it is helpful to review the factors carefully and present evidence on each factor so that the Judge is fully aware of how that factor applies to you as a parent.

Read moreDifficulties in Divorce: What is a Pendente Lite Hearing?

Individuals going through divorce in Virginia will often ask themselves thousands of questions as they tread down the path of separation. One common concern that arises is, broadly speaking, TIME. Most people tense up when they hear how long it can take for a divorce to be finalized—once separation begins, a year or more is the norm. “What do I do until then?” is an incredibly daunting thought. The “what-ifs” are bound to circle around in your head: what if my husband doesn’t provide any support; what if my wife keeps coming around my residence, or removes me from the health insurance policy . . . and so on.

Read moreDiscovery in Divorce: What Documents Do I Need?

As you can imagine, one of the primary issues in a divorce is determining how to split up the assets and debts of the spouses. Given this fact, we are frequently asked by folks what sort of documentation they should gather before their consultation. While it usually is not necessary to have everything prepared before an initial consultation, we decided to create this post to give you a heads-up as to what documentation you are likely to need as the process unfolds.

Documentation Regarding Income:

- Employment Income – usually your pay stubs will suffice,

- Other Income Sources – recent statements or deposit documentation for other income sources such as trust/investment accounts, rental properties, retirement, disability, etc., is usually appropriate.

- Most Recent Tax Return – sometimes earlier returns will become necessary as well.

Deciding to Divorce in Virginia? Frequently Asked Questions!

Choosing the path of divorce can be a very emotional one. In this post we will provide a brief overview of some common questions and concerns.

Is there such thing as a “legal separation”?

- Unlike some other states, in Virginia there is nothing that can be filed with the court to certify that you and your spouse are “legally” separated. However, if you are separating, an attorney can advise you regarding what will constitute the “date of separation” and also what steps you can use to protect yourself during separation.

- Usually, when you ultimately file for divorce, the date that you began living in separate households is considered the date of separation. There are many exceptions to this; it is possible to be separate in the same household. You should speak with an attorney if you have additional questions regarding legal separation.

Adoptions: A Glance at the Different Types and Some Common Concerns

Choosing the route of adoption can be a very exciting, yet scary time for new parents. While there are many important details that you should familiarize yourself with if you are considering adoption, this post provides a quick overview—to make you aware of the types of adoptions and to address a few common concerns.

The First Step: Choosing the type of adoption that is applicable to you.

- Step-Parent Adoption: A step-parent adoption occurs when the adoptive parent is the spouse of the child’s biological mother or father. This adoption normally does not require a home study.

- Parental Placement Adoption: This type of adoption occurs when a birth parent directly places their child with you. There is no agency involved.

- Agency Adoption: This type of adoption occurs when a family chooses to use an agency to find a child. The agency helps the family with the adoption process and handles a lot of the common hurdles that adoptive families face.

- Close Relative Adoption: This type of adoption occurs when the child's grandparent, great-grandparent, adult nephew or niece, adult brother or sister, adult uncle or aunt, or adult great uncle or great aunt decide to adopt a child.

- International Adoption: This occurs when a family decides to adopt a child from outside the United States of America. This is usually done through an agency.

- Adult Adoption: This occurs when there is an adoption of someone over the age of 18.

- Special Needs Adoption: This adoption occurs when a family decides to adopt a child with special needs. There are assistance programs in place from the government to assist families who otherwise may be unable to adopt a child due to the expense involved.

Virginia Child Support Guidelines: a Closer Look at the Ingredients

In Virginia, Court-ordered Child Support amounts are typically determined through the use of Virginia’s Child Support Guidelines.

The support guidelines are a creature of statute (Va. Code Section 20-108.2) and the Court is required to presume that the guideline amount is appropriate (Va. Code Section 20-108.1).

Read moreDomestic Protective Orders in Virginia: Powerful and Prevalent

In Virginia, you may be entitled to a domestic protective order if:

- You have been subject to “family abuse” committed by another,

- You continue to be in fear, and

- A protective order is necessary to prevent further abuse.

Difficulties in Divorce: The Tale of Two Households

The price of separation can be one of the largest hurdles couples face during a divorce. Figuring out how to afford the operation costs of two different households is no easy task. Once the “marital residence” becomes a misnomer, husbands and wives are staring at the same income levels, but twice the bills. Two electric bills, two mortgages or rents, two homes to furnish, clean and repair, and sometimes, two daycare providers.

This is particularly difficult in a lot of situations because the spouses did not consider the cost of running two households. Given that most are overcome with emotion and anxiety during separation, it comes as no surprise that they haven’t first poured over their bank accounts to create a feasible budget for their “new” life. This financial neglect is common even in cases where the almighty dollar was in fact the root cause of marital discord.

Read more